Glanbia’s COVID-19 consumer research spotlights protein NPD, immunity supplements and trending diets

13 May 2021 --- More than a year into the pandemic, Glanbia’s monthly consumer survey to explore the impact of COVID-19 on consumers has found that protein-rich NPD, immunity supplements and low carb diets are trending among consumers.

In March of 2020, Glanbia Nutritionals initiated a monthly consumer survey and has since been tracking consumer attitudes, beliefs, behaviors and perceptions on a variety of topics, including:

- Food and supplement purchases.

- Grocery shopping.

- Home food preparation.

- Diets.

- Exercise behaviors.

This ongoing survey has yielded valuable insights into trends and shifts throughout the length of the pandemic that directly affect the food and supplement industries, the company says.

Consumers report reaching for protein bars and shakes as they are healthy and convenient.Protein NPD

Consumers report reaching for protein bars and shakes as they are healthy and convenient.Protein NPD

In exploring consumers’ use of protein products, which have been especially popular during the pandemic, Glanbia’s findings reveal that the primary eating occasions for protein products are breakfast and snacking.

Whey is the preferred protein for protein bars and powders, while milk protein is preferred for RTD protein shakes, closely followed by whey protein.

Consumers are reaching for protein bars and ready-to-drink (RTD) protein shakes because they are healthy, convenient and easy to grab and go, the company supports.

Compared to pre-COVID days, the percentage of consumers purchasing RTD protein shakes has been steady (at 12 percent), while those purchasing protein powders have increased by three points (to 15 percent).

Though the nutrition bar market has seen fluctuations throughout the pandemic, protein/energy bar purchasing is currently back to pre-pandemic levels (at 20 percent).

Supplements soar

For supplements, the company’s survey shows consumers’ interest in immune system support is below pandemic onset levels.

Around 40 percent of consumers are reporting immunity support as a reason they are taking vitamins, minerals or supplements (VMS).

This stat peaked at pandemic onset at 46 percent and at the end of 2020 with 47 percent of consumers taking VMS for immune health support.

Multivitamins remain at the top as the most common immune support supplement consumers are taking (at 70 percent), overtaking both vitamin C (at 65 percent) and vitamin D (at 63 percent).

Some of the many lifestyle disruptions experienced due to COVID-19 have included more time spent at home, along with reduced access to gyms and organized sports activities.

Some of the many lifestyle disruptions experienced due to COVID-19 have included more time spent at home, along with reduced access to gyms and organized sports activities.

Forty percent of consumers report immunity as a reason they’re taking vitamins or supplements.

Trending diets

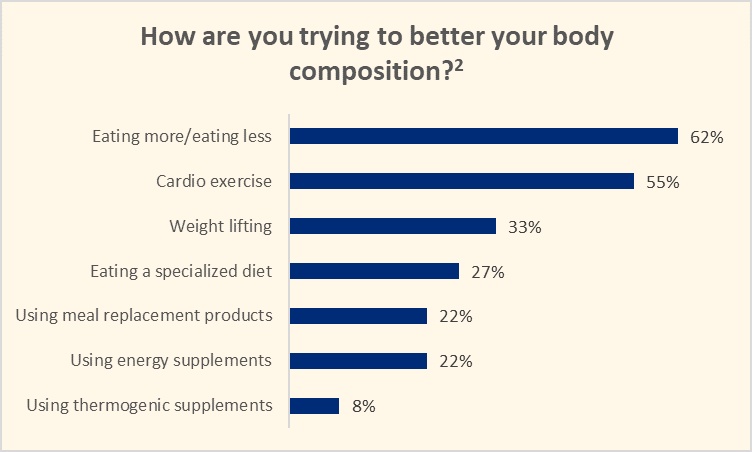

In looking at what steps consumers are taking toward health and fitness goals going into 2021, Glanbia’s survey found the majority (63 percent) of consumers were working on their body composition, with calorie control and cardio as the primary strategies.

Regarding nutrition trends, the most common diets consumers are interested in the new year are low-carb (11 percent), intermittent fasting (9 percent) and lactose-free/low lactose (9 percent).

Shopping habits

Throughout the pandemic, Glanbia’s survey followed consumer shopping habits, which have been characterized by factors like reduced shopping frequency, preference for shelf-stable and bulk-packaged items, and cost-consciousness.

“In our most recent survey, we find that consumers are relying on supercenters more for certain types of products, such as snacks and protein bars. For protein powder purchases, however, there has been a shift toward traditional supermarkets,” the company says.

While in-person grocery shopping is still the most common (at 82 percent), online ordering is going strong, both home-delivered, as well as click-and-collect.

Delivery is more common than pre-pandemic times, with 13 percent of consumers indicating they purchased their groceries online and then had them delivered.

Click-and-collect programs have also benefited with 14 percent of consumers indicating they have done their shopping like this.

Back to normal?

Now a year in, with mass vaccinations underway, everyone is wondering if things will soon return to normal, Glanbia muses.

“The COVID-19 pandemic has impacted how people work, shop, travel, socialize and so much more. Our latest survey shows that consumers are, in fact, gaining optimism regarding normal activities resuming soon, with 23 percent saying ‘not before summer of 2021’ and 22 percent saying ‘not before the end of 2021.’”

About one in five consumers don’t believe they will see normality until 2022, the company adds.

By Kristiana Lalou